Printable Form 1099-NEC

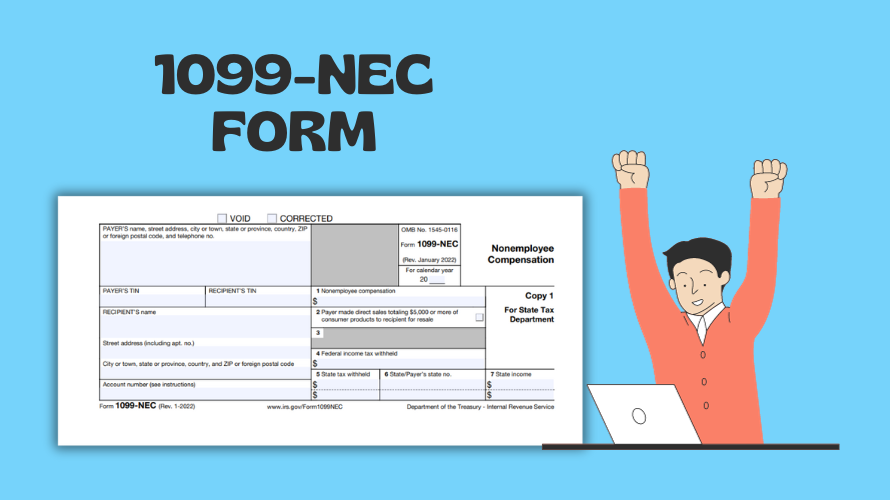

As a freelancer managing your finances, it is essential to understand the intricacies of tax documents, especially the 1099-NEC form. This specific form, which stands for Nonemployee Compensation, is used to report income earned from self-employment or as an independent contractor. The free printable 1099-NEC form is designed with sections that capture crucial tax details, including personal information, income earned, and federal tax withheld if applicable.

The primary fields on the printable IRS Form 1099-NEC include the payers' and recipients' names and Tax Identification Numbers (TINs), which could be social security numbers or employer identification numbers. It also requires an account number if the payer has multiple accounts for a recipient to differentiate. Finally, box 1 is notably important as it is where you'll enter the total nonemployee compensation you received during the tax year.

Guidelines for Blank 1099-NEC Form Completing

- Verify the accuracy of the payers' and payees' legal names and TINs to prevent IRS mismatch.

- Ensure that the total amount of payment entered in box 1 reflects the total nonemployee compensation before any deductions or expenses.

- Do not forget to fill out your contact information, including your address, to have a complete record for both the payer and the IRS.

- If there was any federal income tax withheld, document the amount in box 4 of the form.

- Double-check the form for any errors or omissions before printing and filing, as mistakes could lead to penalties.

Printable Form 1099-NEC - Step-by-Step Filing Guide

To properly file the printable Form 1099-NEC, follow these steps:

- Once the form is accurately filled out, download and print a copy of the printable 1099-NEC form for 2023 for each recipient to report their earnings.

- Mail the recipient's copy (Copy B) to them so they can file their taxes. Ensure that you send it by the deadline to avoid penalties for late delivery.

- For your records, keep Copy C with your important tax documents.

- Before the deadline, submit Copy A of the form to the IRS. You can file electronically using the IRS FIRE system or by mailing the printed forms.

- If you are filing by mail, you also need to include Form 1096, which is a summary of all 1099s you're sending to the IRS.

Important Filing Deadline for Form 1099-NEC

The IRS imposes strict deadlines on tax forms to maintain the financial order. For the printable tax form 1099-NEC, the deadline is usually set to January 31st. This date applies to handing out forms to recipients and filing with the IRS. If January 31st falls on a weekend or holiday, the next business day becomes the due date. Filing your 1099-NEC forms on time is imperative to avoid late penalties and potential audits from the tax authorities.

Freelancers and independent contractors must stay ahead of their tax preparation with the proper tools and information. You can ensure a smoother and more compliant tax season by keeping informed about the requirements for the 1099-NEC form, such as structure, filing steps, and deadlines.

Latest News